IRS proposes new requirement to claim 25C tax credit

January 8, 2024

Investopedia

The Department of the Treasury recently issued a notice stating that the IRS plans to implement a product identification number (PIN) requirement for the 25C tax credit.

Background: The Energy Efficient Home Improvement Credit, commonly known as 25C, allows homeowners to claim a 30% tax credit up to $3,200 for making qualified home improvements, including heat pump upgrades.

- The Inflation Reduction Act extended the nationwide program (which renews every year) through 2032.

- Read more on the credit here.

Details: Starting January 1, 2025, the regulation would require that homeowners can only claim the credit if two conditions are met: 1) the item is produced by a qualified manufacturer, and 2) the homeowner includes the qualified PIN of the item on their tax return.

- The notice defines a “qualified manufacturer” as any manufacturer that commits to assigning a PIN to each item, labeling each item accordingly, and making “periodic written reports” of the PINs to the Secretary of the Treasury.

What’s next: The IRS is requesting comments on the proposal until February 27, 2024. Comments can be submitted here by typing “IRS-2024-13” into the search bar to find the notice.

- Oddly, when we tested it out, it didn’t work — nothing appeared. We contacted support and are waiting to hear back.

📬 Get our stories in your inbox

Keep reading

58 minutes with Work With Your Handz’ CEO Kelly Presgrave

January 19, 2024

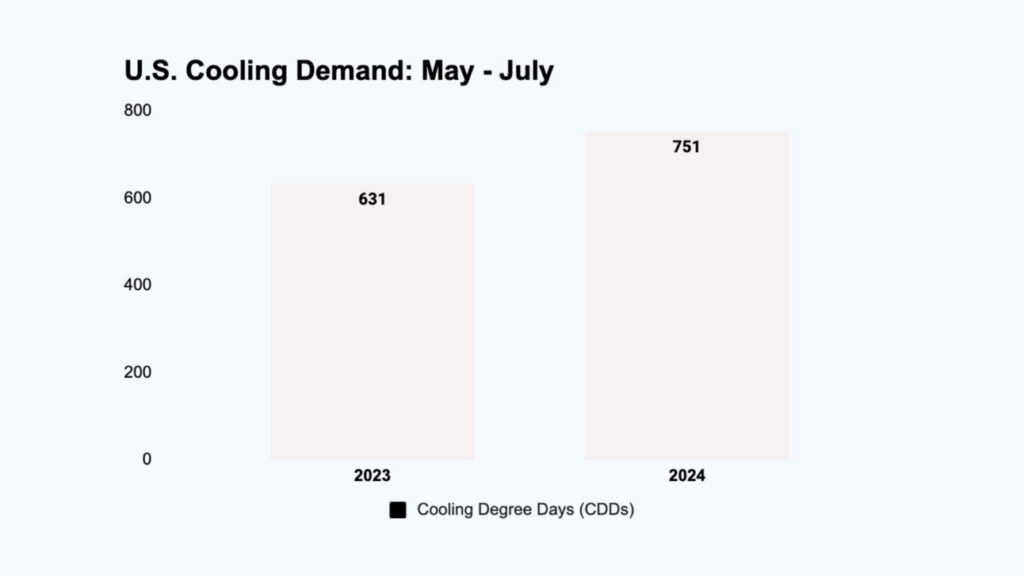

Summer cooling demand jumps 19% year-over-year

From May to July, Cooling Degree Days (CDDs) rose by 19% compared to last year