Mixed signals cloud consumer financing approval outlook

While nationwide FICO scores remain stable, credit delinquencies are at 12-year highs, creating an uncertain financing approval environment

Image: Axios

In 2024, consumer financing applications for service work jumped 37 percent, while applications for HVAC replacements fell seven percent, according to a recent report.

Why it matters: The report reflects growing questions about U.S. consumers’ financial health, which directly impacts their ability to finance both repairs and replacements.

Catch up: Homepros last month examined Americans’ overall financial picture, and mixed signals emerged.

- While consumers earn slightly more than they did in 2019 and continue spending, total credit card balances have risen 24 percent over the past five years — and personal savings have fallen by 13 percent, according to the Federal Reserve.

Driving the news: These increasing pressures threaten Americans’ prospects of getting approved for financing.

What’s happening: As of Q3 2024, the latest available data, both the share of active credit card accounts making minimum payments and the number of accounts with balances at least 30 days past due hit 12-year highs.

- “In response to weaker credit performance, banks are adopting more conservative lending standards,” wrote the Federal Reserve Bank of Philadelphia.

- Meanwhile, total household debt, including mortgages, credit cards, and other consumer loans, has climbed 52 percent since 2015.

Between the lines: The impacts are being especially felt by lower- and middle-income consumers, spurring a pullback in spending, particularly on big-ticket items like home improvements.

Yes, but: The situation hasn’t hit crisis territory yet. The average nationwide FICO score has held steady at around 715 since 2020, according to Experian — an increase from 2010.

- Total household debt payments now consume a smaller portion of Americans’ disposable income, with the overall debt-to-income ratio falling three percent from December 2019 to December 2024.

- The job market — broadly speaking — has also remained strong, with the nationwide unemployment rate hovering at around four percent since 2022.

Of note: “We really do not see this shift [toward repairs],” Carrier CEO David Gitlin said last week. “If there is some pressure on the lower-end consumer, you’re going to see [it], but we have not seen any trends around that.”

What to watch: As President Trump slaps tariffs on imports from several countries, prices for everyday goods are expected to keep rising, pinching American wallets — and potentially affecting creditworthiness.

- The Federal Reserve last week held its effective interest rate steady, as it eyes the impacts of the administration’s decisions, though it indicated possible cuts later this year.

- “It’s really hard to know how this is going to work out,” said Fed Chair Jerome Powell. “In the meantime, it’s appropriate to wait for further clarity.”

📬 Get our stories in your inbox

Keep reading

Bosch to buy Johnson Controls HVAC portfolio for $8 billion

The companies announced an agreement early Tuesday morning

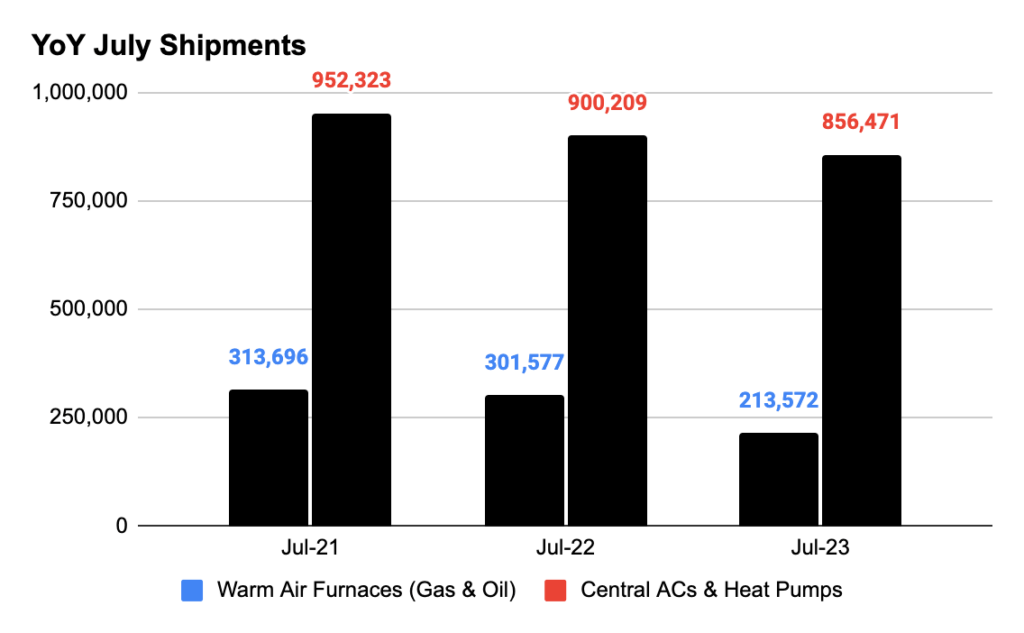

July shipment figures show heat pump slowdown

September 11, 2023

What the HVAC industry is saying in D.C. — Part 1: Labor

Notes from the industry's May visit to Washington