Customers are spending more than last summer, data shows

From May to July, average tickets from organic channels rose by over 10% year-over-year

Image: Axios

Throughout any given month, you can find Jonathan Torrey of analytics startup SearchLight publishing HVAC-industry demand trends and other insightful data from contractors nationwide.

What’s happening: We asked Torrey if he could share some of that data, comparing May to July of this year to 2023, and he was nice enough to say yes.

-

Note: Data is pulled from anonymized samples of HVAC contractors across the U.S.

By the numbers: Lead volume from “organic” channels, which include non-paid Google listings and Facebook, rose 10% year-over-year.

-

Average tickets increased by 12% — a positive, but not enough to keep up with customer acquisition costs, which jumped 14%.

-

Organic channels drove over $360,000 in closed revenue per company from May to July, up 13% from ~$317,000 during the same period last year.

“There is slightly more demand available than in 2023 and a higher amount spent per paying customer, but it is more expensive to acquire them,” Torrey writes in an email.

On Local Services Ads: In June and July, it cost about $50 more to acquire a customer from LSAs than in 2023.

-

However, similar to organic channels, “the average customer from GLSA spent $1,656 more in June and July '24 than in the same period in '23,” Torrey notes.

What to watch for: In August 2023, average tickets were strong, and customer acquisition costs were lower than in June, which, per Torrey, is typically the cheapest month to acquire customers.

-

August data will be published in the coming weeks.

📬 Get our stories in your inbox

Keep reading

“I don’t think there’s a right or wrong answer,” says contractor about private equity

Welcome to Post Close, a monthly series anonymously exploring the thoughts of HVAC contractors who have sold their businesses to a private-equity-backed platform

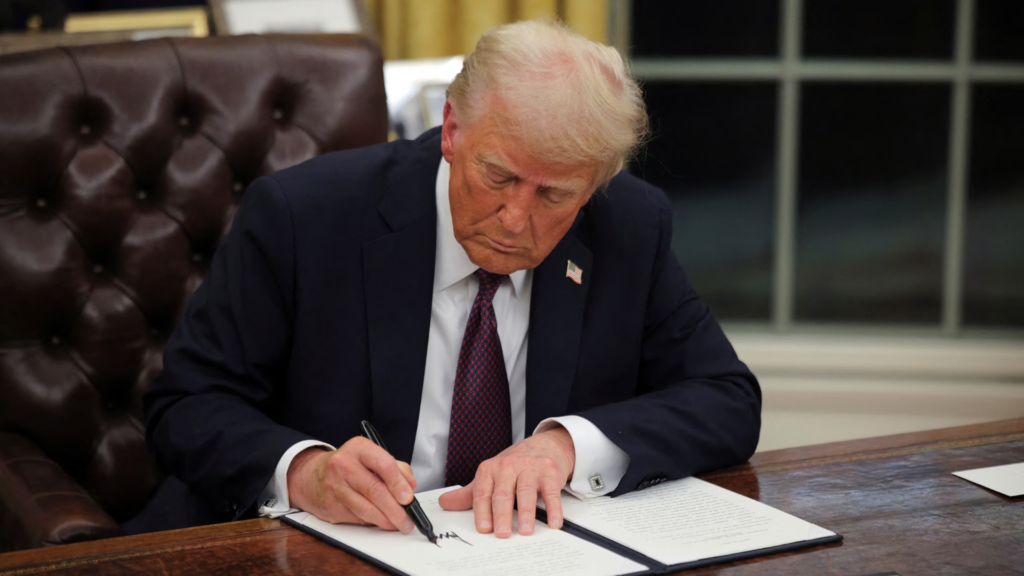

Trump delays tariffs on HVAC imports from Canada, Mexico

The President on Thursday announced that tariffs on certain imports from both countries will be delayed until April 2