Why Bryant is partnering with Walmart

April 1, 2024

Image: PR Newswire, Walmart

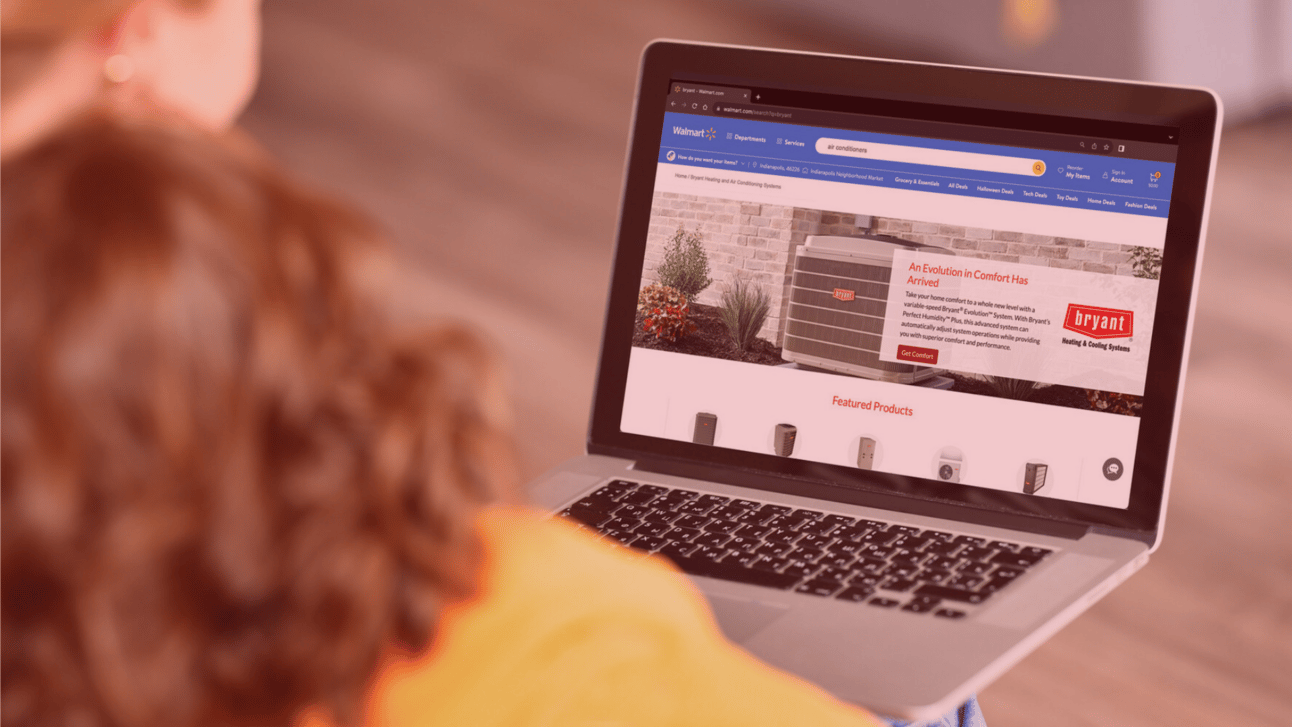

Walmart recently announced a partnership with Bryant Heating & Cooling, giving its online shoppers a direct path to local Bryant dealers. Our first thought: Why?

The big picture: Consumers’ willingness to buy big-ticket items online (versus just smaller, everyday usuals) has increased.

Details: Customers shopping on Walmart’s website can explore Bryant equipment and navigate directly to a landing page connecting them with participating local dealers.

-

Buyers get a 5% point-of-sale discount, with access to financing options and a 10-year warranty.

The logic: Walmart is in deep competition with everyone’s favorite trillion-dollar gorilla: Amazon. Adding HVAC equipment not only expands its offering and opens a new revenue stream, but gives customers another reason to stay on its website, where they’ll likely buy more stuff in the process.

-

For Bryant, gaining access to Walmart’s 120 million weekly online customers is a no-brainer. It’s the ultimate “top-of-funnel” move — for dealers, too.

Zooming out: Bryant’s not the only manufacturer to capitalize on the shift to online buying. Lennox’s arrangement with Contractor Commerce, announced last month, will feed traffic from its Dealer Locator to participating contractors’ websites, where customers can actually buy equipment.

-

Landing customers in the hands of contractors, instead of bypassing them, is a key point in both manufacturers’ initiatives, as Paul Redman of Contractor Commerce told Homepros.

What’s next: The partnership is only active in select markets, but a nationwide rollout is planned for 2025.

💭 What we’re pondering: The question may not be “if”, but rather “when” will other manufacturers follow suit? And what changes will contractors have to make when that happens? Let us know your thoughts.

📬 Get our stories in your inbox

Keep reading

Customers are spending more than last summer, data shows

From May to July, average tickets from organic channels rose by over 10% year-over-year

The FTC banned fake, deceptive reviews. Here’s what it means for contractors

As of October 2024, "purchasing" fake reviews by offering customers discounts is banned, along with a few similar practices

Goettl, SmartAC.com collaborate to juice up membership offerings

September 11, 2023