Contractors split over how suppliers should handle tariff costs, survey finds

A division exists among contractors on how distributors and manufacturers should pass on tariff costs, according to a survey

Image: CoinGlass

As a result of tariffs announced over the past two months, contractors — unsurprisingly — expect product costs to rise, but are split on how suppliers should handle them, according to a recent HARDI survey of nearly 40 contractors shared with Homepros.

The big picture: As of today, eight of the top 10 exporting countries of HVAC products to the U.S. face at least a 10 percent tariff rate, with China’s reaching 145 percent. Catch up

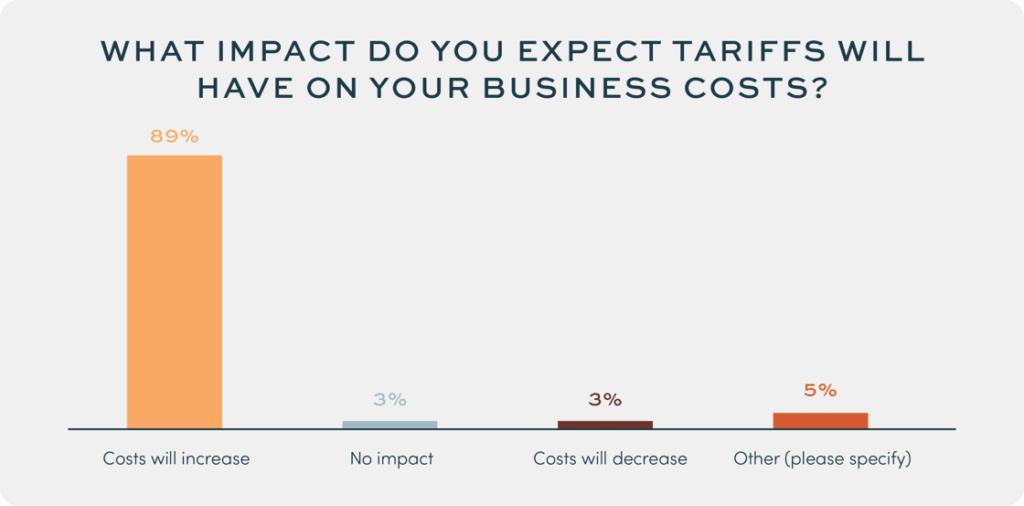

What’s happening: When asked about tariffs’ expected cost impacts, 89 percent of survey participants said costs will increase. Three percent expect no impact, and, notably, another three percent said costs will decrease as a result.

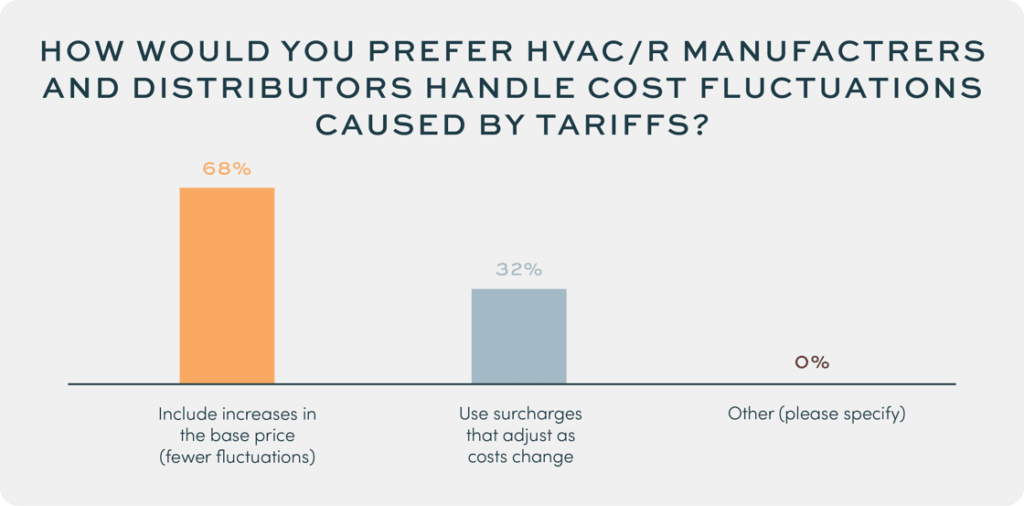

Zoom in: Despite the agreement on rising costs, contractors were divided on how distributors and manufacturers should handle them.

- 68 percent prefer increases applied to a product’s base price, while the remaining 32 percent opt for surcharges that adjust as costs change.

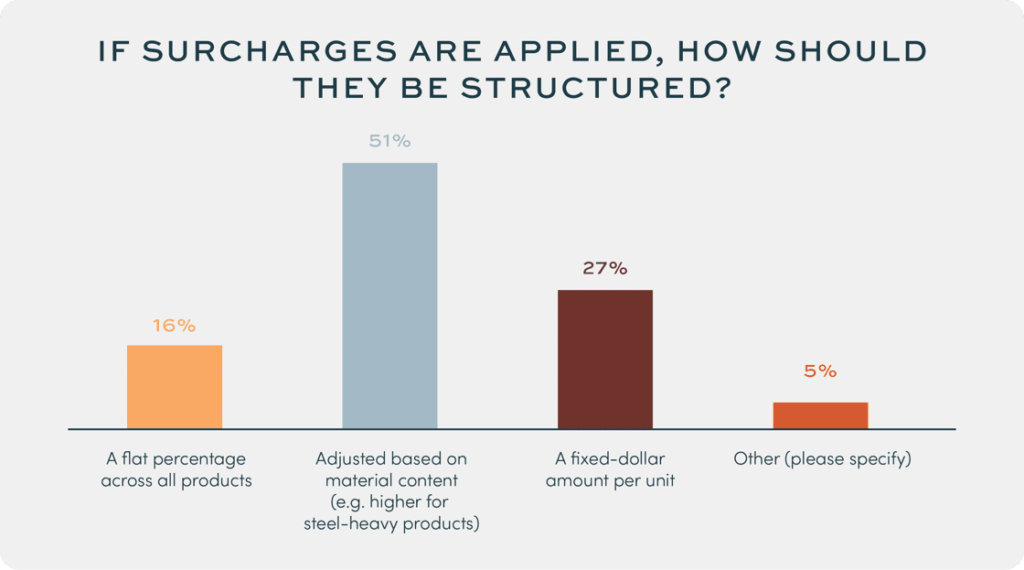

Of note: In the case of surcharges, 51 percent indicated a preference for tying them directly to a product’s material content — for instance, higher surcharges for steel-heavy products, given the metal’s 25 percent tariff rate.

- 27 percent lean toward a fixed-dollar amount per unit, while 16 percent support a flat percentage across all products.

- The remaining contractors marked ‘Other,’ noting that pricing “is not their area of expertise, and that manufacturers and distributors should adjust prices ‘as needed,’” according to HARDI.

Between the lines: In line with the consensus on cost impacts, most contractors also “strongly advocated” for documentation, communication, and clear reasoning from suppliers, considering the environment’s volatility.

- “[I’d like] more transparency on the increases by product type,” one contractor said. “[A]ny documented information explaining (in detail) the situation would be helpful… Customers want to hear from the source, not the middleman.”

What to watch: “Other contractors urged manufacturers and distributors to actively support lobbying efforts against tariffs, adjust pricing promptly should tariffs cease, and remain transparent about their pricing strategies to prevent any suspicion of price gouging,” wrote HARDI’s Grace Helser.

- The bottom line: “Ultimately, the survey brings forth a key message we see time and again in contractor surveys: HVAC/R contractors seek consistent, transparent, and proactive support from manufacturers and distributors during periods of economic uncertainty,” Helser added.

Editor’s note: Images belong to HARDI.

📬 Get our stories in your inbox

Keep reading

Small business, HVAC get a pulse check

October 9, 2023

Trump administration halts efficiency mandates for ACs

The Department of Energy will postpone the implementation of efficiency mandates for central air conditioners, gas water heaters, and more