Lennox, Trane CEOs weigh in on 2025

Lennox and Trane this week reported Q4 earnings, marking the companies' first public statements since January brought significant changes

Image: Trane, Lennox

Lennox and Trane this week reported Q4 earnings, and their executives outlined what’s happening — and their expectations for the year ahead.

Why it matters: This marks the companies’ first public statements since January brought significant changes: The cutoff for producing 410A systems, a new administration, and looming tariff concerns.

On A2L: Ahead of January 1, both companies experienced “pre-buying” of 410A equipment (in Q3 and Q4), which they expect to clear over the next few months.

- “It’ll kind of start to mitigate and be gone, fully gone by the second quarter,” said Lennox CFO Michael Quenzer, adding, “Our plan still is a 10 percent price increase, on average, on the R-454B product.”

- “[Our] team did a nice job of executing the changeover to the A2L refrigerant… We have the capability of running mixed model lines in our factories so we can support the aftermarket for 410,” noted Trane CEO Dave Regnery.

On the residential market: The companies presented slightly different outlooks for residential demand. “We believe residential markets have largely normalized,” Regnery said, though Trane didn’t disclose its volume expectations for this year.

- “[IRA] money is… really starting to be deployed,” he added. “That could be a tailwind for 2025. And then consumer confidence and tax cuts… Those are all things that could be beneficial.”

Meanwhile, Lennox anticipates its residential unit volume to be flat this year. “There’s a lot of uncertainty in the market. Existing home sales are at a very low level, [and] interest rates and mortgage rates continue to be high,” said Lennox CEO Alok Maskara.

- “Based on what we saw in 2024, we continue to model a flattish industry volume,” he added. “It may be a little conservative, but given the uncertainty in the market, it just seems like that’s the right assumption to make at this point.”

On tariffs: Both manufacturers acknowledged that tariffs would have an impact — but expressed confidence in their ability to navigate them, should they happen.

- “We’ve dealt with tariffs in the past,” Regnery noted. “Do I think they could impact our supply chain? For sure. But we understand our cost inputs, and if we see something change, we’re going to act very quickly.”

Lennox spoke in a similar tone. “We’ve done a really good job at reducing our supply chain reliance on China,” Maskara said. “And the fact that we did the Samsung joint venture also means that our mini splits are now coming from Korea, not China.”

- “40 percent of the industry capacity is in Mexico, which means if tariffs come in, we’ll all have to work through [them],” he added.

- “If [they’re] long term, we’ll start looking at making more product [at our plants] in Marshalltown, [Iowa], and Orangeburg, [South Carolina].”

📬 Get our stories in your inbox

Keep reading

HVAC Deals: June 2024

Recent investment activity from around the industry

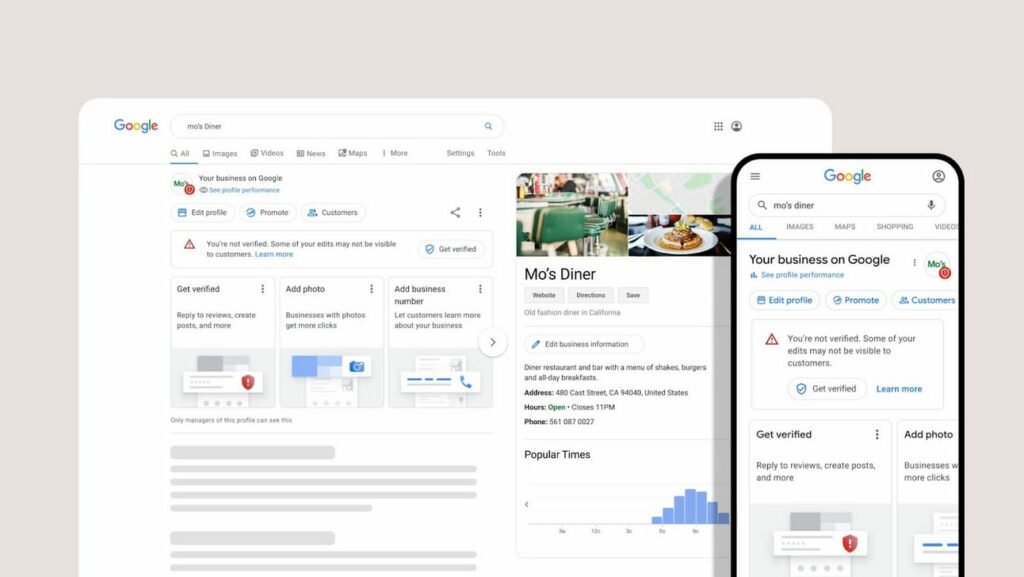

Google now displays social media posts on Business Profiles

March 25, 2024

Columbia Home Services, P1 Service Group near merger

The deal will mark the third platform-level HVAC transaction this year, and represents the first true merger between established groups