Mortgage rates dip, but tariffs cloud outlook for HVAC demand

While the average 30-year fixed mortgage rate, which impacts replacement demand, has fallen slightly in 2025, tariffs cloud what's next

Image: Fortune

The average 30-year fixed mortgage rate has fallen since early 2025, according to Freddie Mac data, though it remains elevated compared to a few years ago.

Why it matters: There’s a historical relationship between existing home sales — influenced by mortgage rates — and residential improvement spending, including HVAC replacements.

What’s happening: The average 30-year fixed mortgage rate topped seven percent in mid-January before dropping roughly half a point to 6.6 percent last week. Existing home sales grew four percent in February.

- Meanwhile, the new administration’s sweeping tariffs on over 50 countries have injected a fresh shot of uncertainty into the economy, causing the Federal Reserve to adopt a ‘wait-and-see’ approach to future interest rate cuts.

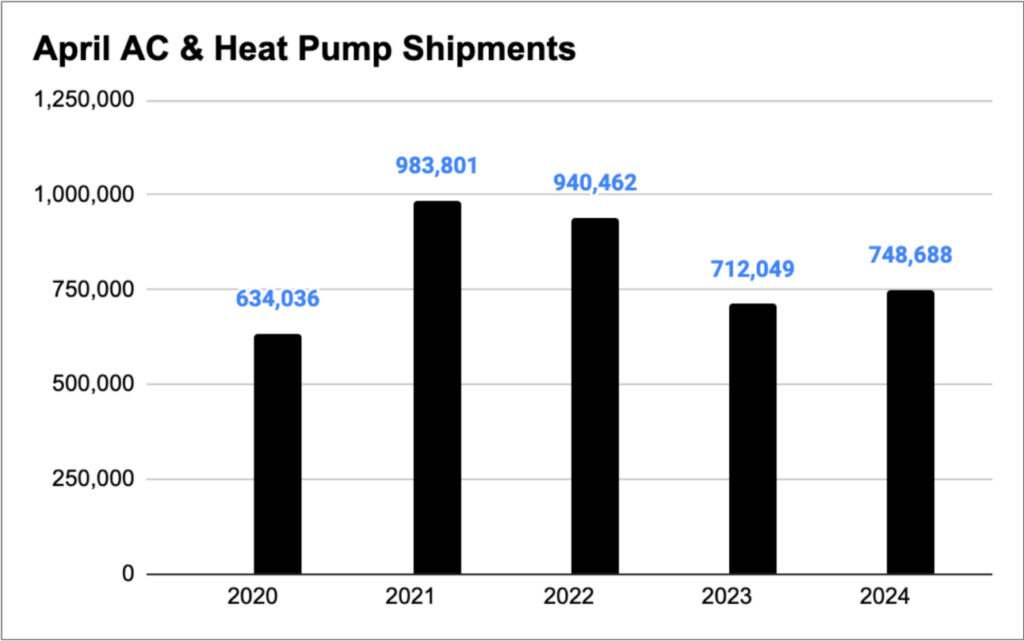

Zoom out: During Covid, falling mortgage rates pushed existing home sales to “new heights,” driving 20 percent annual growth in residential improvement spending from 2020 to 2022, HARDI reports. Central air conditioner and heat pump shipments grew 11 percent during the same period.

- “Yet, upward momentum was stifled in 2022 as mortgage rates jumped,” HARDI notes in its latest industry report.

- “With most homeowners benefitting from mortgage rates locked in prior to the 2022 rate increases, home sale activity has declined to levels not seen since the Great Recession, and spending on residential improvements has fallen accordingly.”

Between the lines: Despite the shift, positive signals for HVAC demand emerged entering this year. Total HVAC shipments rebounded last year, growing 12 percent compared to 2023.

- While existing home sales have dropped 35 percent over the past three years, they’ve bottomed out, according to HARDI.

- Additionally, active listings — a precursor to home sales — in March rose 28 percent compared to March 2024, Federal Reserve data shows.

What they’re saying: “[N]early three years after the first interest rate hikes, the industry finds itself in a holding pattern,” HARDI writes.

- “While add-on and replacement volumes rebounded moderately in 2024, the market’s ultimate growth potential will remain limited until mortgage rates fall to a level more in line with the rates of outstanding mortgages,” it adds.

What to watch: While economists predicted relatively stable mortgage rates for 2025, the recent tariffs introduce new uncertainty that could push rates in either direction.

- “If President Trump keeps these tariffs in place rather than using them as a short-term bargaining tool, bond yields could see continued downward pressure, bringing mortgage rates down with them,” said Dan Richards, president of Flyhomes Mortgage.

Conversely, “In an environment where the average new 30-year fixed rate mortgage is above 6.5 percent, we see existing home sale volumes in 2025 remaining roughly on par with their 2024 volumes,” says HARDI.

- “Based on that trajectory, our base case assumption for residential HVAC demand in 2025 is slightly above flat growth: 1 percent from 2024 levels.”

📬 Get our stories in your inbox

Keep reading

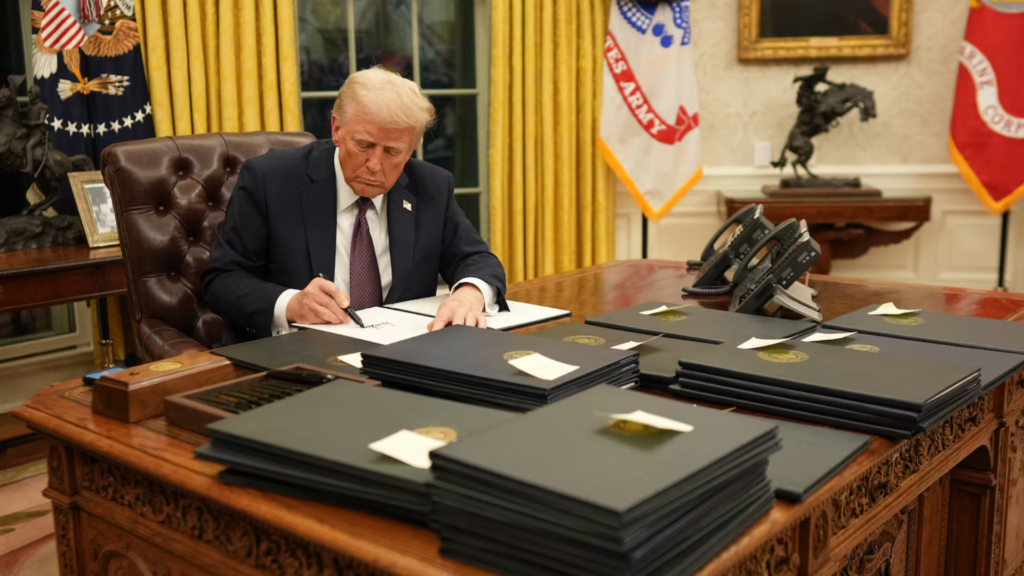

Trump order creates uncertainty for HVAC rebate programs

The President on Monday signed an order requiring the Department of Energy to “immediately pause the disbursement of funds” under the IRA