What do contractors overlook regarding financials?

Notes on pricing, average tickets, gross margins, and labor efficiency

Image: Wall Street Journal

Browse any online contractor group and you’ll find the same topics thrown around almost daily: Pricing, average tickets, gross margins, and labor efficiency, among others.

With that in mind, we caught up with Paul Maskill, who started Blue Collar Business Advisors after a successful run of building and selling electrical companies, to cover what smaller to mid-sized contractors often overlook regarding financials — and took some notes.

The big picture: Ideally, as most of you know, residential HVAC companies (with no new construction) operate at 50%+ gross margins. But many, particularly those below $10 million in revenue, miss a few things when managing financials.

-

“Labor and material are the two biggest inputs [of cost-of-goods-sold], but people tend to miss the ancillary stuff that should be included, like vehicle maintenance and fuel, tools, equipment rentals, and subcontractors,” Maskill notes.

-

He adds that labor isn’t always structured correctly, either. “A good action item is to open up your books and see if your payroll is actually split — your field payroll in cost-of-goods-sold, and your office payroll below.”

On labor efficiency: “Hidden” costs can sneak up and hurt gross margins.

-

“If you’re paying techs $30 an hour, it’s probably $40 once you add payroll tax, PTO, healthcare, etc. And if they’re working 50% of the time, now you’re up to $80 an hour,” Maskill says.

-

“That’s your direct cost, so [assuming nothing else], to get to 50% gross profit, you already have to charge $160.”

Zoom in: “If techs work a 10-hour day, it’ll cost you $400. But if they’re only on the job for 5 out of 10 hours because they’re also driving and taking lunch, you need to account that it’s $80 for the 5 hours they’re on site,” he explains.

-

“A lot of companies will say, ‘I pay my guy $40 an hour, so I’ll mark that up to get 50% margin, and charge $80.’ But if you mark it up to $80, you’re really just at your cost because half the time, they’re not working,” he adds.

-

“I think from a pricing standpoint, using 50% [efficiency] is a little conservative. Ideally, it’s more than that, but by factoring that in, you’re protecting your downside.”

On pricing: Time and material is a lose-lose setup because it incentivizes techs to take longer, which doesn’t benefit customers, Maskill argues.

-

“[With] hourly, the people who make the most money are the worst technicians because they take longer, and then they make even more money when they screw things up and go back to fix them,” he says.

-

Yes, but: “With performance pay, the client wins because the technician’s incentivized to get it done right, the technician wins because they’re gonna make more money, and the company wins because they’re gonna attract the best people.”

On average tickets: It’s no secret that presenting multiple options with financing can increase average tickets. But, as Maskill points out, even today, not everybody buys it.

-

“The old school thought is, ‘Well, they didn’t call for [other options].’ But if something does happen and we didn’t bring it to their attention, they’re gonna be really upset with us,” he says.

-

“If you go [to the doctor] because your knee hurts, and they don’t take your blood pressure, and then you have a heart attack, it’s like them saying, ‘Wow, his blood pressure’s through the roof, but we didn’t take it because he was here for his knee.’”

On managing cash: Maskill highlighted “Parkinson’s Law” — which says that work expands to the time we allow it; if you wait until the last minute, it only takes a minute to do — applying it to money.

-

“Money without a ‘job’ will get spent,” he says. “This idea is that twice a month, you move money into different buckets. You can put money aside for operating expenses, taxes, and owner’s compensation.”

-

“And one of the great things about it, [for example], is that when it comes time to pay your tax bill at the end of the quarter or the year, you’ve already set the money aside.”

The bottom line: Whether you manage a billion-dollar investment firm or run a $7 million-a-year HVAC shop, a few tweaks here and there can go a long way.

📬 Get our stories in your inbox

Keep reading

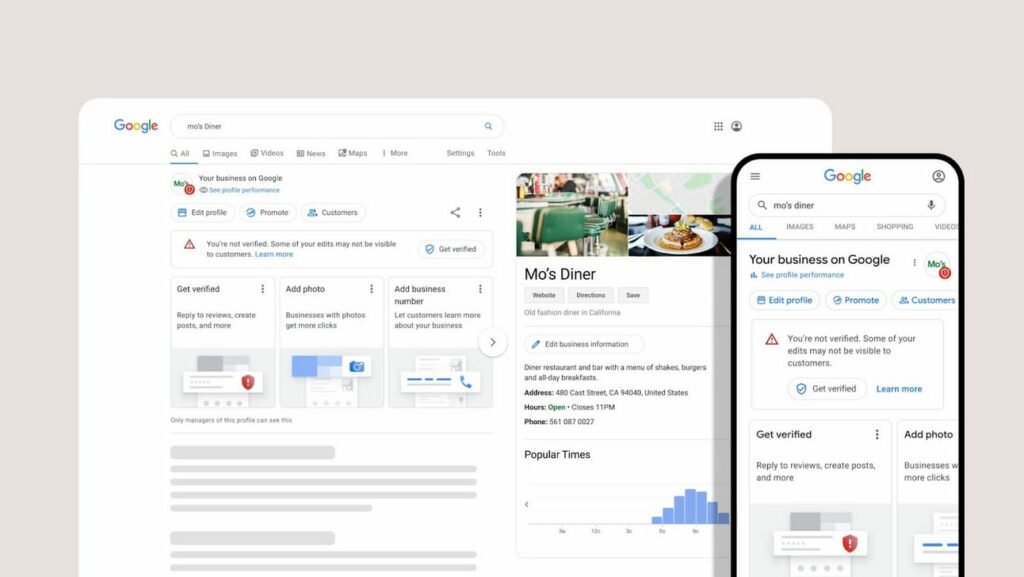

Google now displays social media posts on Business Profiles

March 25, 2024

Carrier, Lennox report Q3 earnings

October 30, 2023