Inside The Wilson Companies’ path to $100 million with John Wilson

Notes on hiring front-line managers, private equity, and scaling to $100 million

❝

The only way you grow a business is with more leads, and the only way you service those leads is with more people… The bigger the business has become, the more simple we see it.

John Wilson is the CEO of The Wilson Companies, an eight-figure, Ohio-based holding company that includes HVAC, plumbing, electrical, restoration, and septic services, along with Owned and Operated, where he helps home service operators scale their businesses.

John is a hard-charging, fast-moving CEO — with quite the personality — who’s grown his family business by many multiples and is on the way to $100 million in revenue. We talked about hiring front-line managers, reducing AR, scaling, thoughts on private equity, and more.

Can you tell me a little bit about your background?

Our family business was founded in 1958 — it’s 66 years old. I came in right after high school during the recession, and for the first few years, saw a lot of people go out of business. I developed a deep hatred for new construction because of that, haha.

I went to college a few times, but it didn’t stick; I kept pushing in the business. When I was 23, I started talking to my dad about buying it. So we got it valued, and I bought 49%, ran it for a few years, and then bought another chunk. We ended up buying more companies from there, and the rest was history. That gave me the perspective that you can acquire to grow.

Of everything you can do to grow your company, are there a couple of things you focus on most?

The only way you grow a business is with more leads, and the only way you service those leads is with more people — my big focuses are lead flow and recruitment. Those will be the most impactful in the coming years, but what has been the most impactful is probably getting the right people in the right seats.

But that’s it, you have to get more opportunities and then put people in front of those opportunities. The bigger the business has become, the more simple we see it. Like, it’s not that deep; I think I overcomplicated it a lot when it was earlier in the journey.

How do you think about hiring front-line managers?

One thing I have a strong stance on is promoting technicians. I didn’t used to think it, but promotions from within is my current stance.

We’ve found that our success rate for promotions from within is like 90%. Our success rate with outside hires (for front-line leadership roles) is like 20-30%. So the very first thing we look at is, “What talent do we have in the organization that is under-utilized?” And then, “Can I train this person?”, “Do they hit our core values?”, “Could they be a leader and do they have a coaching mindset?”. We really want to grow from within.

And frankly, I think it’s faster. I used to think it was slower, but I think it’s faster — because they know the business, they know the players, they know the rules, and what they need to learn is the role. When you bring a new person in, they don’t know sh*t. You have to train all of that. So you don’t know if that person’s successful for six months, but you know if a promotion’s successful in 30 days. We’ve been able to speed up our growth with promotions.

You tweeted that you lowered your accounts receivable (AR) from over $1 million to below $200,000. How’d you do that?

One of the practices that we got off track doing two years ago is a daily huddle. We’re getting back on track now, but we used to measure the percentage of revenue collected every single day. When we were $2-3 million, I used to watch that metric every day, and then we six-timed and I stopped watching it. So we started tracking it again and I found out our percentage of revenue collected is like 40%, which is insane.

Now we’re measuring it and implementing actions to do better. We created a lot of new processes around it and really held people’s feet to the fire. If we have low collection rates on a per-person basis, we’re gonna talk to you about it. We listened to every single phone call of CSRs and dispatchers and if you didn’t go through the new process of how we collect money, you’re gonna get pulled in. It took 30 to 40 days of intense culture change, but now our collection rates are 98% a day.

I also implemented a daily AR check-in. I sit with our AR clerk every day and we literally discuss every single job. Even if it’s $5, [we discuss] why we didn’t collect and what actions she’s gonna take to collect that day.

❝

Compensation will get more egregious, which will bring in more labor, which is ultimately a net good for society.

Thoughts on private equity and consolidation?

I don’t think it’s good or bad, I think it just “is.” It’s not that black and white. I think in general, it will force growth [of the labor pool]. Compensation will get more egregious, which will bring in more labor, which is ultimately a net good for society.

I think that’s the biggest impact it’s gonna have. Institutional capital is coming in, and we’ll literally run out of people to do the work, so they will correct the labor shortage because they have to. And that’s a net good for everyone — it’s higher-paid jobs for Americans, it’s good for communities, and it’s good for other businesses because it creates a wider talent pool to recruit from.

And every company over $20-30 million has the same solution: build a trade school. All PE is doing is creating more companies over $20-30 million.

So building in-house trade schools is the answer, but it’s still a challenge to find interested people, no?

It is not even remotely complicated to find people who want to learn the trades. This isn’t 2003 or 2004 when I was in school and my teacher said, “If you don’t get good at this class, you’re gonna become a plumber when you grow up.”

I can open up TikTok or Instagram and find twenty-somethings starting blue-collar companies on every swipe. I think it’s well-established that you can make a lot of money without college debt. I know more and more very young people wanting to choose that route because the facts are real — you can make $100,000 at 25 and own a home with no college debt. It’s very easy to find people who want to get into the trades; it’s more complicated to train them at scale, well.

Where does Wilson Companies fit into that?

We’re a blend between a searcher and private equity. Our business is 66 years old, which means a track record, and on top of that, we have scale — regionally, everyone knows who we are.

So when we talk to local operators, we have the same conversation about advantages as private equity does. We have a full HR, accounting, and marketing team; our benefits are better, our pay is better, our customers are better, and our pricing is better. For most of our suppliers, we’re on the same pricing tier as every PE group.

We have the luxury of playing both of those cards. Searchers don’t have a track record, they’re just nice, and PE has all the advantages, but it’s PE — so we get to be both.

What does the future look like for you?

In 2024, I’m not expecting to make any acquisitions. Breaking the threshold of $15-20 million takes a huge amount of professionalization that we’re still working through. Getting the right people inside our support team, figuring out front-line leadership and training programs, and developing winning marketing strategies have consumed my life. I think an acquisition would be a distraction to what we’re already doing successfully.

Long term, businesses only do two things: sell or shut down. We expect to sell it someday, but the big focus right now is getting to $100 million in revenue. It’s a big, interesting challenge that I think we can and will do. We’re expecting to be there by 2030.

I know you at least try to have a life outside of work, so what do you do?

Most of my activities are solo activities — skiing, running, and reading. My ideal day would be to wake up, lift, drink a bunch of coffee, come to work and be an extravert for seven hours, then go hide and read, run, and ski for the rest of the day.

I’m married and have two kids, and I do like them a lot. Cooking’s fun. I’m also better at Call of Duty than you think.

If you could have dinner with anyone in history, who would it be?

There’s a guy named Joshua Kennon who’s a financial blogger. He was doing HoldCo’s fifteen years ago before they were a thing. He had a letterman jacket business, a book business, a financial consulting thing, and it was just fascinating.

I learned how to cobble together acquisitions, I learned tax, and I learned most of the foundational stuff that I use every single day from reading his blog in 2008-2011, so it’d probably be that guy.

I’ve tried reaching out to him to tell him he changed my life but his DMs are closed; I really do need to fly out to him.

📬 Get our stories in your inbox

Keep reading

ServiceTitan report reveals contractor insights

December 4, 2023

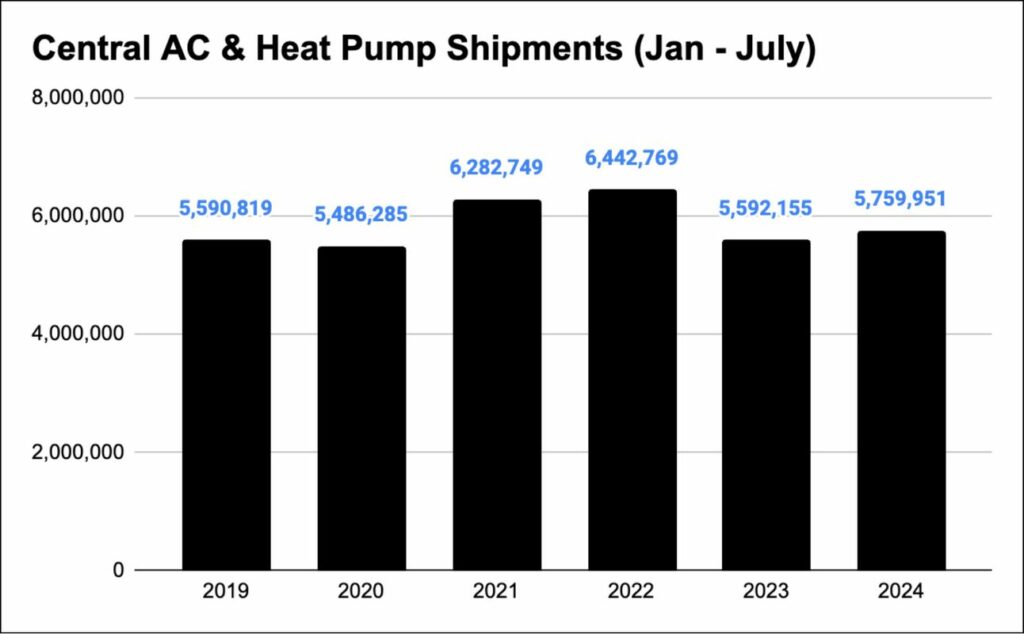

July HVAC shipments up 22%

Central AC and heat pump shipments rose 22% year-over-year in July, and year-to-date shipments increased by 3% from 2023

Austin Helms on building a perpetual company and hitting $20 million along the way

Notes on growth, retaining talent, and building a perpetual company