Synchrony to buy Ally Financial’s consumer financing business

January 22, 2024

Synchrony CEO, Brian Doubles. Image: American Banker

Synchrony announced it’s buying Ally Financial’s point-of-sale financing business, Ally Lending, which offers home improvement loans and has a $2.2 billion book of business.

The big picture: As prices rise — especially across the HVAC industry — the role of financing becomes more important.

-

One estimate says point-of-sale consumer financing makes up 3.5% of all US consumer spending.

Details: The deal adds ~2,500 merchants (HVAC contractors included) and 450,000 borrowers to Synchrony’s customer base. “This expands Synchrony's multi-product strategy by extending its revolving credit and promotional financing products to Ally Lending's merchants,” the announcement said.

-

"This deal represents a significant and exciting growth opportunity for Synchrony — it's a strong strategic fit that will unlock value… by integrating products and teams in our expanding platforms of home improvement and health and wellness," said Synchrony CEO Brian Doubles.

Of note: This isn’t the first time home improvement lenders have been targeted in M&A deals. In 2021, Truist Bank acquired Service Finance for $2 billion, Goldman Sachs bought Greensky for a similar amount, and Regions Bank acquired EnerBank for ~$1 billion.

-

This past October, however, Goldman announced it was offloading Greensky for a rumored fraction of what it paid.

What’s next: Synchrony will provide more information on the deal today during its earnings call.

📬 Get our stories in your inbox

Keep reading

HVAC sales strategy with Preferred Home Services’ Ryane Sweeney

Notes on day-to-day meetings, unsold opportunities, and filling sales gaps

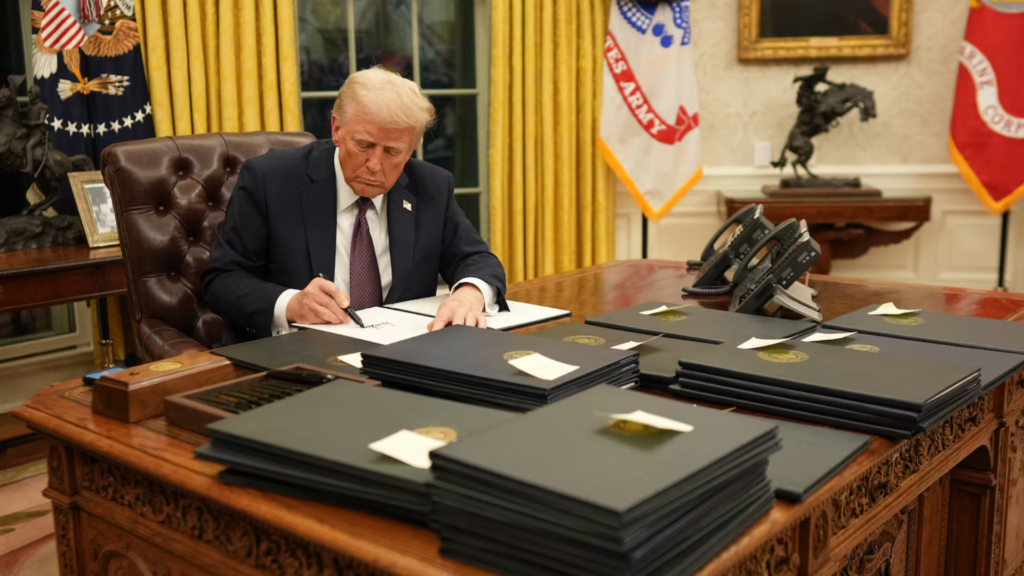

Trump order creates uncertainty for HVAC rebate programs

The President on Monday signed an order requiring the Department of Energy to “immediately pause the disbursement of funds” under the IRA

Q&A: The state of recruiting in HVAC

A conversation about recruiting in HVAC, including onboarding, employee referral programs, handling limited budgets, and more