The ripple effect: How distributor consolidation could impact contractors

Like with all consolidation, there are pros and cons. But in this case, two factors stand out

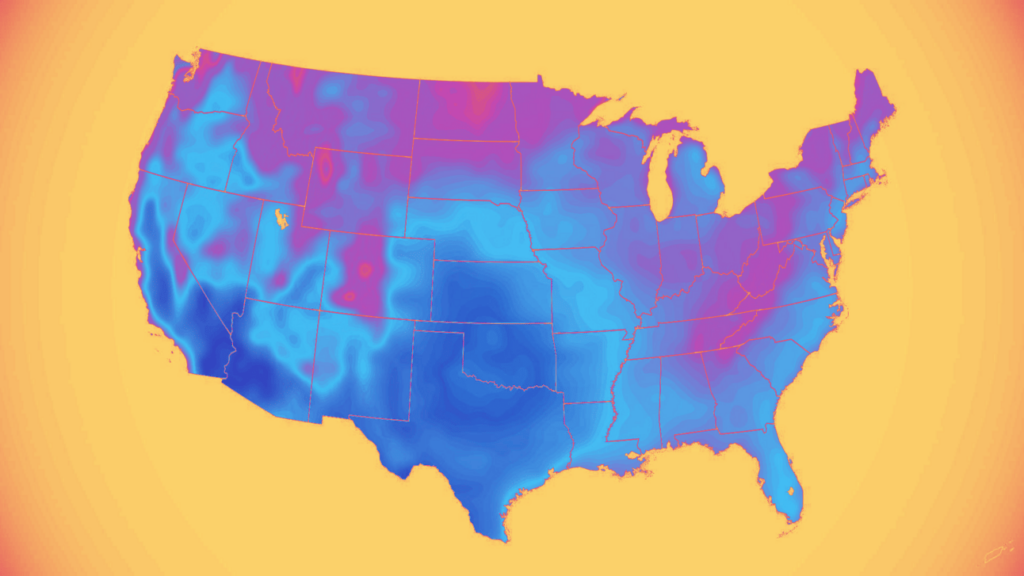

Image: HARDI

Most of our M&A coverage focuses on contractors, but consolidation is also happening one level up the chain — among distributors.

The big picture: Like contracting, wholesale distribution is fragmented. While the numbers vary by source, one recent report says there are over 2,000 HVAC distributors in the U.S.

-

In just the past 18 months, Winsupply, Shearer Supply, Watsco, and Team Air, among others, have all announced or completed acquisitions.

-

During the same period, two distributor-focused roll-up firms launched: Tigertail Capital Partners and QXO, which received a modest $1 billion investment in June.

Why it matters: The logic for distributors to consolidate makes sense: Financial returns aside, they can better meet contractors where they’re at.

-

“If you’re an HVAC distributor, and your best customer gets PE-backed and now has a plumbing arm, you want to get into that as well,” HARDI’s Zak Page tells Homepros.

The implications: Like with all consolidation, there are pros and cons. But in this case, two factors stand out.

-

When an acquisition is made, the acquirer beefs up its balance sheet, and the acquired company gains access to those resources — at least in some way.

-

This enables a big pro: Larger tech investments.

“Think about the product shortages of the past couple of years… more technology will allow distributors to be [more] scientific and better forecast their demand,” Page explains.

-

“Technology helps in terms of ease of ordering, product availability, real-time pricing, and things of that nature — whatever can make it easier and more reliable for a contractor to get products,” he adds.

-

Watsco is a clear example of technology bets paying off: Its e-commerce sales, for instance, grew nearly twice as fast as its overall sales in the second quarter.

Yes, but: Consolidation also gives distributors leverage, potentially hurting the negotiating power of smaller contractors, as discounting decisions, for example, are made on a larger scale.

-

“While consolidation can bring about improved efficiencies… it may also increase dependence on a few major distributors,” says M&A advisor Sam Kaplan.

-

“The decrease in the number of independent distributors results in reduced competition… This reduction could diminish contractors' ability to negotiate favorable terms and pricing, [and] access to specialized products,” he adds.

Zoom out: As the industry evolves, contractors are looking more to distributors for education, especially with regulations like the A2L refrigerant transition, Page notes.

-

“I’d hope and think that any influx of capital into these distributors allows them to be better educational partners to their contractors,” he says.

Of note: While distributor consolidation is happening, HARDI estimates that deal volume has declined by “mid-teens” over the past year.

-

There isn’t a public data source showing all distributor transaction activity.

The bottom line: Consolidation may be polarizing, but whether it’ll meaningfully strain the long-term relationship between contractors and suppliers is still up for question.

-

After giving us his input on distributors’ growing leverage, one person added, “For what it’s worth, I had a smaller owner tell me they thought the opposite today.”

Thoughts? Let us know

📬 Get our stories in your inbox

Keep reading

$13 billion HVAC disruption averted in port deal

An agreement was reached on Wednesday, preventing a port strike that could have impacted roughly $13 billion worth of HVAC goods

Most Read: Q2 2024

The top five reads from the last quarter, in order