Voomi Supply CEO on tariffs, refrigerant supply, and digital demand

A conversation about today's dynamics, including the ripple effect of tariffs, refrigerant supply, and e-commerce demand

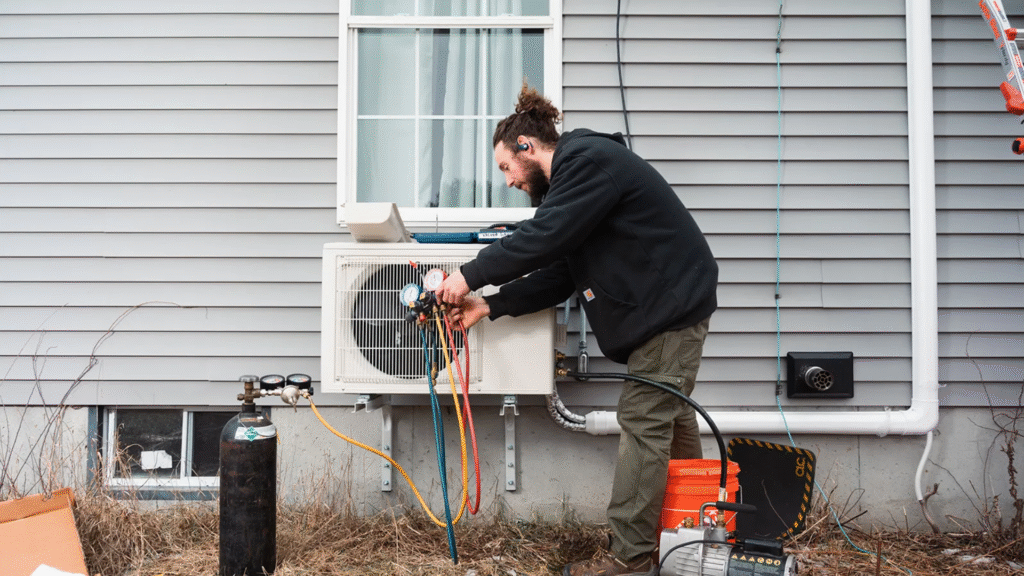

Image: Daikin

The HVAC industry — amid the transition to a new class of refrigerants — has seen a slew of headlines over the past few months, including on-again, off-again tariffs, R-454B supply challenges, and price increases.

To get a broad perspective on today’s dynamics, given his vantage point, I spoke with RJ Cilley, CEO of Voomi Supply, an e-commerce platform that enables distributors and manufacturers to sell products nationwide — online. Below is our conversation, lightly edited for clarity.

You work with a plethora of distributors nationwide, who, in turn, work with thousands of contractors. What have you noticed over the past few months from a demand standpoint?

We saw a spike in March, as customers stocked up ahead of tariff uncertainty and [due to] the R-410A transition. [In] April and May, our platform grew a lot, but there were fewer “stocking” behaviors. However, there are still a lot of questions about our R-410A levels — people still want it.

What do those inventory levels look like?

Distributors are racing to move R-410A. Manufacturers that transitioned early are already out, but those that made the switch later still have product in the channel. With cooling season here, there’s a short window to clear that inventory before it becomes obsolete.

Have you made any observations regarding the R-454B issues that have been circulating recently?

We sell a lot of R-454B cylinders, and Southern states, compared to others, are having a hard time finding supply. We’ve seen a few big demand spikes — during those, it seemed like we were the only ones online with access to the product. But market comments and the overall sentiment suggest that supply will be better in the back half of the year.

What about tariffs?

It’s early, and like with Covid, the real ripple effects won’t show up for months — we’ll have to wait and see how all of this unfolds.

The biggest impact of tariffs is the inconsistency in how price increases are handled. Some add surcharges, others bake them into the price. As costs move from OEMs to distributors to contractors, it’s easy for things to get lost in translation. That disconnect creates risk for everyone’s margins.

Consumers ‘trading down’ is a big part of that conversation, but OEMs on earnings calls have said they haven’t seen it yet. Any thoughts or observations on that?

Consumers have held up so far, but it feels fragile. OEMs haven’t seen trading down yet, but with rising debt levels and inflation not being fully tamed, it wouldn’t take much for spending to tighten, especially on new purchases.

Are you seeing e-commerce purchase volume, in particular, growing?

As I mentioned, our business has really taken off this year. E-commerce is driving the conversation across the industry, and it’s only going one way: Up. Our platform gives distributors and OEMs national e-commerce exposure overnight. We’re adding new partners every week and continue to prove that we’re the fastest way to tap into digital demand at scale, quickly.

What else are you talking to distributors about right now?

The big question is how equipment vs. parts will play out online. We sell some equipment, but mostly parts and supplies. Online sales eliminate regional barriers, which puts greater pressure on how pricing and localization are managed. It feels like a tipping point is coming, and it’s what we’re actively discussing with partners.

📬 Get our stories in your inbox

Keep reading

Carrier and Lennox report earnings, eye 2025 price increases

A roundup of comments from Carrier and Lennox's Q3 earnings calls

HVAC industry enters era of ‘accelerated change’: Report

A roundup of highlights from a 13-page industry report published on Wednesday, covering market trends, private equity, and challenges ahead

What Amazon Can Teach HVAC Contractors About Company Culture

Some of the highest-performing companies in the world have weird cultures