Home improvement heavyweights report earnings, share homeowner insights

August 29, 2023

The Spruce

During the second quarter, Home Depot generated $42.9B in revenue, narrowly beating estimates, and Lowe’s generated $24.9B, slightly missing estimates.

When giving FY 2023 guidance, both retailers said they expect sales declines of 2-5% compared to last year.

The main reason: The unusually high demand for home improvement, fueled by the pandemic over the past few years, is starting to fade.

Earnings calls highlighted that they’re also seeing similar trends with customers:

- Consumers are pulling back on big-ticket, discretionary purchases (appliances, patios) as interest rates remain high, and are electing for smaller purchases in the meantime.

- Homeowners are, generally speaking, in good financial shape – largely due to home equity gains during the pandemic.

- Long term, spending on home improvements and repairs should be fine due to the aging housing stock and increasing millennial homeownership, but will be choppy in the short term given an uncertain economic climate.

- Pro project backlogs are down from last year but are still healthy and higher than historic levels.

- Side note: Home Depot generates about 50% of its revenue from Pros, and for Lowe’s, that number is around 25%.

- Sales from their Pros and Online (e-commerce) segments are offsetting the softening in consumer sales.

Keep in mind: Although consumers face an uncertain economic future, HVAC repair and replacement demand should be less susceptible to macroeconomic events compared to other home services, given its non-discretionary nature.

📬 Get our stories in your inbox

Keep reading

“We’re cautiously optimistic”: CEO on A2L, consumer sentiment, and 2025

The past 24 months have seen ups and downs in consumer confidence and HVAC shipments, and January brought a significant change

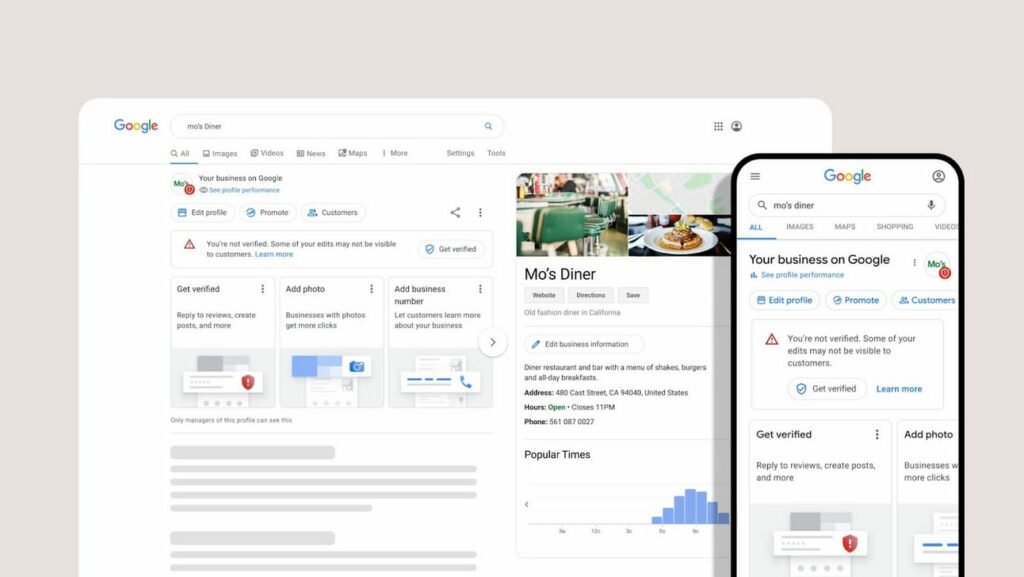

Google now displays social media posts on Business Profiles

March 25, 2024

Quick take: Q&A with Gorjanc Home Services’ CFO, COO

In a market crowded with private equity-backed players, Gorjanc is an independent contractor on track to grow revenue over 20% this year